September 1st, 2025

All Atlas Clients –

Hope you enjoyed your summer and found some downtime for yourselves and perhaps did something different that piqued your interest. Just in case you weren’t paying attention to the markets over the summer to the political (domestic) and geo-political environment, nothing happened and not much going on. Kidding! The market has been on a tear since the April lows following the “Tariff Tantrum” and hit all-time highs by the last week of August. Q2 and Q3 corporate earnings were very good, especially with the Top 10 Stocks in the S&P 500 that have been driving the index upward for almost three years running. Let’s break down many of the factors that have happened and what to expect the balance of the year. We will still post a Q4 Newsletter on October 1st.

Market Cycles

The S&P 500 is up almost 26% from the April 8th lows and the political and geo-political environment has had significant impact on the market, but also specific sectors of the market. Some include Defense, Technology, Biotech/Healthcare and Financials. The market can’t go up forever without some breathers. Remember in several past newsletters we have discussed market cycles and on average there are at least three(3) 5% pullbacks per year, this is healthy. If you review the last 15 years in the market, every pullback (dip) has been a green light to keep Buying, especially higher quality stocks that have had good earnings and growing that bottom line.

Historically, September is the worst month of the year for market index performance. There are varying opinions on why, some include profit-taking from summer rallies or preparation for Q3 earnings in October that may or may not meet or exceed expectations. Holiday forecasts start to come out in September and October as most of the retailers had to put in their orders by June and July to receive their goods before the holiday season. How many retailers have had success anticipating what consumers will purchase in December back in June and July, very few. Some of those indications are gleaned from the “back-to-school” retail spending which was just “ok or average” this year.

Don’t be surprised if September and possibly October are down months for the market. This could be a very good opportunity to Buy or add to high quality positions in your portfolio. There are some headwinds out there for better market performance, but most of them have been there for several years (discussed further in this Atlas Note).

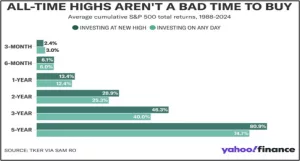

Buying at All-Time Highs

The fear of adding new money to your positions and portfolio at all-time highs are the thoughts of “is the market to expensive, has select positions peaked on their share price” always ramble around your brain. The truth of the matter is no one is smart enough to know the market peaks and troughs. But you want to keep away from “dumpster diving” when the market is at all-time highs. Meaning, the stocks that are struggling for momentum, earnings are flat-to-down and revenue that has stagnated, why would you put fresh money into those companies? Looking for a turnaround? Better have patience and time on your side if you are right. In the meantime, go with momentum and high-quality stocks that are performing well and contributing to the upward movements of the market.

|

If you were to “only” Buy at the market all-time highs, you still made out as long as “Time is on your side” and you have patience and sometimes a strong stomach. |

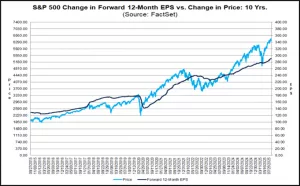

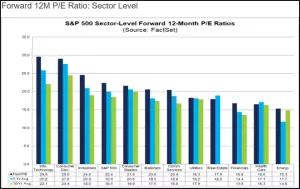

Earnings and What to expect the balance of 2025

The P/E Ratio (Price/Earnings) indicator which many investors and market strategists look at for valuation try to determine if the P/E is undervalued, overvalued or fairly valued. The S&P 500 Index P/E is 22.1 and is above the 5-year and 10-year average. Meaning, the market is probably overvalued and as we have seen through many market cycles, the market can continue to run higher, and the P/E can expand higher for quite some time.

The anticipation of a lower Fed Interest Rate pushed the markets higher after the Jackson Hole economic speech from the Fed Chairman. It looks like we will be lower anywhere between .25bps – 1.00bps by end of 2025. That will have a positive impact on reissuance of our debt and possibly push down the 10-year Treasury that will hopefully depress 30-Year Mortgage Rates under 6% and perhaps push it down towards 5%. This would be a new boom for home buying and refinancing. The refinancing will provide consumers with more money to spend and give retail and entertainment fuel to push their sectors higher.

|

|

Headwinds

- Ukraine and Russia finding a path to peace and does the EU get involved.

- Sanctions against Russia.

- Tariffs against select countries and how will they retaliate and eventually have an impact on our consumers.

- Israel vs. Gaza/Iran/Syria/Lebanon, etc. and how will that eventually ever find temporary peace.

- Increase in Inflation possibly from Tariffs and lowering the Fed Interest Rate going into 2026.

- High Credit Card carry over debt and our National Debt breaching the $37T level.

Tailwinds

- The OBBB(One Big Beautiful Bill) being signed will help several people and businesses, mostly starting in 2026.

- The lowering of the Fed Interest Rates will have a positive effect in several sectors including housing and financials.

- AI spending feels likes it’s a “land grab” and everyone is buying the land, even if they don’t know how much they will need.

- Generally, a positive feeling among businesses and still a very low unemployment rate that increases spending.

As always, please reach out to share your thoughts. Be safe and healthy!

With Best Wishes,

Ronald E. Lang, Principal and Chief Investment Officer

Atlas Wealth Management, LLC