October 1st, 2025

All Atlas Clients –

Here we are in the last quarter of the year, and the Fall Season (my favorite) is almost upon us. Historically, September and October are the two worst performing months of the year. September turned out to be a positive month, but the old adage, “the trees don’t grow into the skies”, meaning the market doesn’t go straight up with some corrections. As we have stated in many newsletters over the years, there is an average of three(3) 5% pullbacks (corrections) in the market each calendar year. The next one could be a terrific buying opportunity towards quality positions in your accounts/portfolio. Unless there is an exogenous shock to the markets, i.e. Geo-political, financial/banking crisis, etc. we may buck the historical trend of a 2nd Year of a Presidential Term being flat to negative. The new tax code and enthusiasm for business and infrastructure investment in the United States will continue through 2026 and 2027. The similarity to the Dot Com era is the “build out” of AI and related-services and industries is the possibility or probability of the “over building” for it. Meaning the infrastructure for Dot Com was overbuilt and it seemed like a land grab and one competitor must outspend the other without knowing the ROI and even how much they should spend. There is a whiff of that with AI and we will have to see how things pan out. The market is up 14%+ for the year, lead mostly by the Top 10 stocks and isn’t often that the market is up double-digits three(3) years in a row.

Tariffs Impact So Far

Currently there is “moderate” affect of inflation from Tariffs. The true impact of this will be reflected in year-end numbers, especially from the Retail, Industrial and select consumer goods sectors. Much of their goods and raw materials are imported. It is also quite possible that those companies didn’t want to be in the crosshairs and receive the ire of the Administration if they complained too much or did raise prices precipitously in the first six months, so they may raise them in 2026 once the dust settles. Basically, the old analogy of slowly increasing the heat in a pot of boiling water so the frog doesn’t initially feel the shock may apply.

Buying at All-Time Highs

In our mid-quarter note we spoke about Buying or adding to your positions at All-Time Highs. It’s tough because you always want to buy at a discount (who doesn’t want a bargain), but with Money Market and High-Yield accounts offering less in return, the market is really the only place to put your money if you want it to grow over time. There is an estimated $7T+ in cash and cash-equivalent related assets. Meaning there is all that cash on the sidelines and will need to find a home now that Money Market yields are under 4% and will continue to go lower as the Fed lowers rates, would see two(2) more .25bps cuts before end of 2025. Yes, the market could go higher, but don’t be shocked when there is a modest pullback and the Financial Media has nothing better to do than write sensational headlines such as; “Is this the end of the Bull Market?”, “AI spending is over” or “This pullback is the beginning of something bigger!”. You must filter out the noise, even if you have “Altitude Sickness” with the market at All-Time Highs. Prudent investing has always proven that even at highs, the highest quality companies will drive the market higher.

Where is our economy now?

A lot of this answer truly depends on where you live. People are still spending and especially going out to eat. How are your restaurants on Thursday, Friday and Saturday nights? Booked, mostly booked, how many people are waiting for a table or at the bar for a drink. I’m not saying its “Gatsby Time”, but people still want a night(s) out and they are spending accordingly. With low unemployment, there are consistent contributions to 401(k) and related plans that are continually adding money to the stock market. Credit is still fairly loose even though Credit Card carry over debt (month to month) is at all-time highs, even at an average rate over 22% APY. That is insane! So are people just financing their life? I don’t see it any other way. Food, drink, cars, vacations, kids fun, etc. going on a credit card and will paid sometime in the future. Not sure that is the best way to live. Eventually it will come back to bite them. Student debt is still ubiquitous and isn’t going away. When is that going to be a true burden? The combination of those two credit crunches is also preventing or inhibiting them from buying and owning a home. As long as the consumer is happy and spending, the economic engine continues to run hot. Reshoring business and manufacturing back to the United States will be a big boost to the economy, but not overnight. This will take time, but investors look at future impact and pricing it accordingly.

Revenue and Earnings

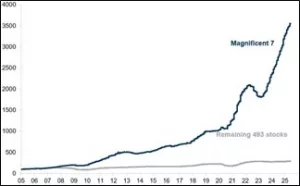

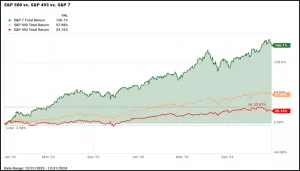

Q3 Corporate Announcements will truly set the stage for 2026 so listen for more content involving AI Spending, Guidance for next quarter and full-year, Investments in R&D, Anticipated Hiring and possible cost increase impacts from Tariffs. There is an expectation of 5%+ Earnings Annual increase for the S&P 500 companies, 8%-10%+ for the Top 10. They are still driving the market, and the Top 10 companies now make up 40% of the S&P 500 Index. Meaning the other 490 are doing well as a whole, but certainly don’t have the top and bottom line like the Top 10, especially the Top 7.

See Charts Below of those Top 7 Stocks and how much they have outperformed the rest of the S&P 500 over the last 20 years, especially the last 3 years.

What to expect the balance of 2025

Headwinds

- Ukraine and Russia finding a path to peace and does the EU get involved.

- Sanctions against Russia.

- Tariffs against select countries and how will they retaliate and eventually have an impact on our consumers.

- Israel vs. Gaza/Iran/Syria/Lebanon, etc. and how will that eventually ever find temporary peace.

- Increase in Inflation possibly from Tariffs and lowering the Fed Interest Rate going into 2026.

- High Credit Card carry over debt and our National Debt breaching the $37T level.

Tailwinds

- The OBBB(One Big Beautiful Bill) being signed will help several people and businesses, mostly starting in 2026.

- The lowering of the Fed Interest Rates will have a positive effect in several sectors including housing and financials.

- AI spending feels likes it’s a “land grab” and everyone is buying the land, even if they don’t know how much they will need.

- Generally, there is a positive feeling among businesses and still a very low unemployment rate that increases spending.

We are beginning to start our Fall Client Reviews, but if we don’t connect, enjoy the Fall weather and the holidays. As always, thank you for thinking of us with your referrals and your trust and faith in us for what we do for you and other clientele.

As always, please reach out to share your thoughts. Be safe and healthy!

With Best Wishes,

Ronald E. Lang, Principal and Chief Investment Officer

Atlas Wealth Management, LLC